Finance: Page 7

-

2024 Elections

Analysts see ‘a real fear in the market’ as renewable energy stocks plummet on election results

Tariffs and other policy actions favored by Trump could drive renewable energy prices higher over the next four years, industry analysts say.

By Emma Penrod • Nov. 8, 2024 -

2024 Elections

Clean energy, sustainable investors brace for second Trump presidency

Experts expect private sector work on ESG issues and the clean energy transition to continue, albeit at a slower pace, under a reelected Donald Trump.

By Lamar Johnson • Nov. 7, 2024 -

SEC says funds mischaracterizing use of ESG factors

The assessment is part of a broader risk alert by the agency regarding the discrepancy between funds’ investment strategies and marketing literature.

By Lamar Johnson • Nov. 6, 2024 -

Climate experts launch insurance nonprofit to curb natural disaster-associated risks

Insurance for Good aims to “harness risk transfer in support of social and environmental goals” and focus on improving disaster recovery within the United States.

By Zoya Mirza • Nov. 5, 2024 -

Marsh to insure carbon credits against counterfeits, fraud

The insurance broker said the new insurance facility will help de-risk carbon credit investments and protect companies from potential “fraudsters.”

By Lamar Johnson • Nov. 5, 2024 -

SEC says Vanguard can nix human rights shareholder proposals from 2025 proxy materials

The agency agreed that two sets of the firms’ funds can exclude a proposal to provide greater transparency to ensure their investments don’t “substantially contribute to genocide.”

By Lamar Johnson • Nov. 4, 2024 -

New Jersey AG accuses Republic First of redlining

The failed lender originated 6% of its home loans to residents of majority-nonwhite neighborhoods between 2018 and 2022, the state found. The state filed a claim with the FDIC seeking remediation.

By Dan Ennis • Nov. 1, 2024 -

ENGIE strikes deal with Meta to supply 260 MW of solar

The project is located in Milam County, Texas, and will supply power to a Meta data center 10 miles away in Temple.

By Diana DiGangi • Nov. 1, 2024 -

HSBC drops CSO from exec board, insists it’s not gearing up to split

The bank confirmed Tuesday that Chief Sustainability Officer Celine Herweijer will not be a part of its re-organized executive operating committee.

By Dan Ennis • Oct. 31, 2024 -

Net-Zero Asset Owner Alliance members invested $175B in climate solutions in 2023: report

The UN-backed group said its 88 members have committed a total of $555 billion towards climate-focused investments from its inception through last year.

By Zoya Mirza • Oct. 30, 2024 -

SEC panel urged to back shareholder rights, proposal process

Shareholders’ rights advocates urged the agency's Investor Advisory Committee to defend the current proposal process as a “vital right of shareholders” against attempts to dilute them.

By Lamar Johnson • Oct. 29, 2024 -

Microsoft clinches ocean-based carbon removal deal with Ebb Carbon

The tech giant will contract an initial 1,333 tons of carbon dioxide removal with options to purchase up to 350,000 tonnes of removal over 10 years.

By Lamar Johnson • Oct. 28, 2024 -

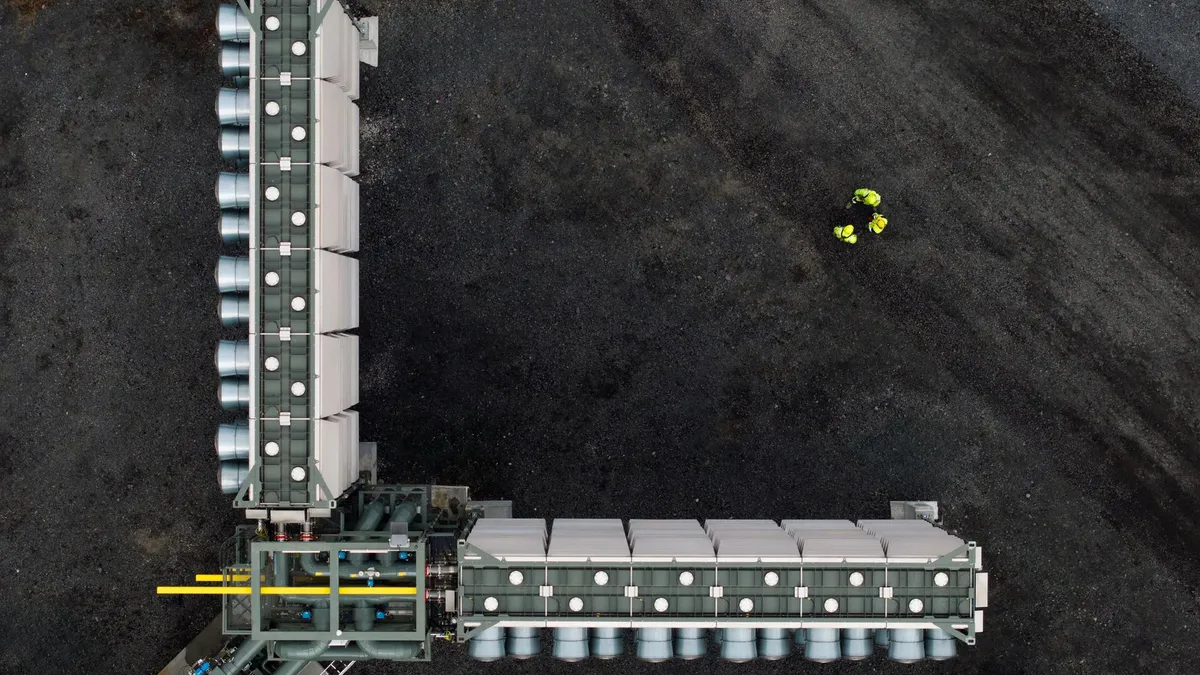

Morgan Stanley inks carbon removal deal with Climeworks

The deal is the financial institution’s first foray into direct air capture credit purchasing and expands Climeworks’ U.S. footprint.

By Lamar Johnson • Oct. 25, 2024 -

SEC slaps $4M fine on WisdomTree over greenwashing

The Securities and Exchange Commission is fining the New York-based asset manager for falsely advertising the investment strategy of three funds to have considered ESG factors.

By Zoya Mirza • Oct. 24, 2024 -

BlackRock targeted for greenwashing in ClientEarth complaint

The environmental nonprofit sent a complaint to French regulators alleging the firm is mislabeling funds as “sustainable,” despite holding $1 billion in fossil fuel investments.

By Lamar Johnson • Updated Oct. 25, 2024 -

Most finance leaders believe sustainability targets out of reach: EY

CFOs leading companies active in the U.S. and Europe face a “fluid picture” when attempting to meet regulations for sustainability reporting, EY said.

By Jim Tyson • Oct. 24, 2024 -

NYC comptroller proposes stopping pensions’ private market investments in fossil fuels

The funds would be the first U.S. public pension plans to have exclusions on investing in fossil fuel infrastructure like pipelines and liquefied natural gas terminals.

By Lamar Johnson • Oct. 23, 2024 -

Renewable PPA prices continue to rise — and may do so through 2030, say LevelTen, Ascend analysts

Project delays, tariffs and a new round of supply shortages pushed renewable energy prices higher in the third quarter of 2024.

By Emma Penrod • Oct. 23, 2024 -

JPMorgan hires NOAA climate scientist to lead climate advisory practice

Sarah Kapnick rejoins the bank after a stint as the National Oceanic and Atmospheric Administration’s presidentially-appointed top scientist.

By Lamar Johnson • Oct. 22, 2024 -

DOL, red states reprise stances on Loper Bright’s effect on ESG rule

The case is back before the U.S. district court judge whose initial dismissal in September 2023 relied on the now-overturned Chevron Doctrine.

By Lamar Johnson • Oct. 21, 2024 -

Climate Week NYC 2024: a retrospective on major announcements, deals

This year’s iteration of the event spanned across 600 events in the city, congregating business leaders, key decision makers and heads of government from all over the world.

By Zoya Mirza , Lamar Johnson • Oct. 21, 2024 -

CalSTRS taps Ninety One to manage $150M sustainability mandate

The California State Teachers’ Retirement System is appointing the investment firm’s decarbonization-focused Global Environment Strategy to oversee the mandate.

By Zoya Mirza • Oct. 17, 2024 -

Meta joins DOE initiative, pledges $35M for carbon removal projects

The tech conglomerate said the funding is a “direct response” to the Department of Energy’s carbon removal purchase program launched earlier this year.

By Zoya Mirza • Oct. 16, 2024 -

JPMorgan Chase, Capital One commit $260M to Arizona solar project

The tax equity financing deal for BrightNight’s Box Canyon project is structured to give the banks access to production tax credits.

By Lamar Johnson • Oct. 16, 2024 -

Real estate firm CBRE acquires NRG Energy’s renewable advisory group

The deal will bolster its ability to help clients integrate renewable energy across their real estate portfolios and facilitate clean power deals, CBRE says.

By Joe Burns • Oct. 16, 2024