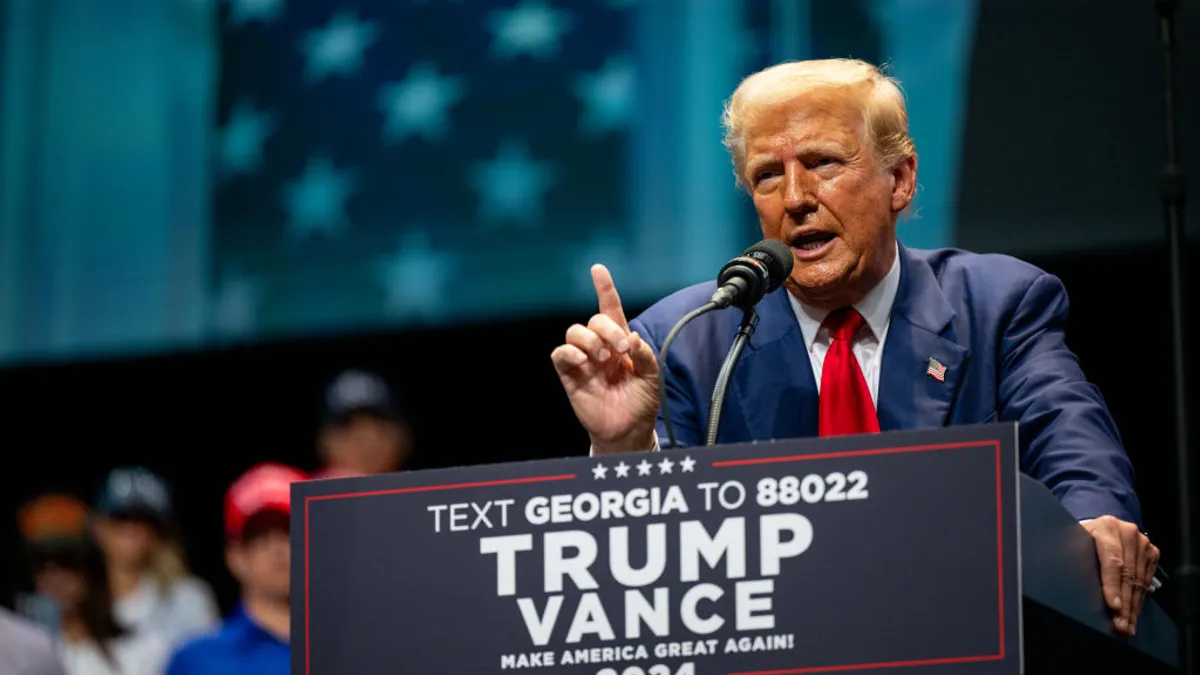

Former President Donald Trump scored a second term in the White House earlier this week, defeating Vice President Kamala Harris in a contentious election race that hinged on issues like abortion rights, foreign policy and the economy.

With Trump back in Washington, the Republican party taking control of the U.S. Senate and the Supreme Court comprising a conservative-leaning majority, experts have expressed concerns about what this concentrated power could entail for the future of U.S actions on climate and ESG. Some of these concerns have centered on the fate of the rules and regulations put forward by federal agencies under the Biden administration.

Morningstar Indexes’ Head of ESG Strategy Tom Kuh previously told ESG Dive that Trump would likely look to “roll back” climate-related disclosure rules and “continue to undermine the ability of federal agencies to regulate.”

“This has implications for regulatory rulemaking and enforcement on air quality, clean water and greenhouse gas emissions reduction; worker safety; food safety, etc.” he warned.

An analysis from Carbon Brief earlier this year estimated that a second Trump administration could lead to an additional 4 billion tonnes of carbon dioxide emissions by 2030 and cause global climate damages worth over $900 billion. The U.S. would “very likely” miss its Paris Agreement-aligned decarbonization targets by a “wide margin” under a second Trump term, with emissions expected to only fall 28% below 2005 levels by the end of the decade, Carbon Brief concluded. The U.S. currently has a goal of reducing emissions by 50-52% by 2030.

Here’s a look at the agency rules that are most likely to face challenges under a second Trump administration.

ESG-related regulations from the Securities and Exchange Commission

The Securities and Exchange Commission passed its final climate-risk disclosure rule in March, but was immediately met with several legal challenges. Many of these challenges were initiated by Republican-led states and questioned the agency’s authority to promulgate the rule. Consequently, the SEC stayed the rule in April and continues to work through the lawsuits.

The final rule requires large companies to disclose climate-related risks that have had or are “reasonably likely to have” material impacts for companies. Companies would also have to disclose any mitigation or climate adaptations they have undertaken “as part of its strategy;” the use, if any, of internal carbon prices, transition plans or scenario analysis; and processes related to oversight and management of climate risks. Investors have increasingly pushed for standardized, comparable climate disclosures.

Since unveiling an initial proposal for the rule in 2022, the agency has received over 24,000 comments on the rule, according to SEC Chair Gary Gensler. And the challenges came despite the agency dropping a requirement for companies to disclose scope 3 emissions and paring down scope 1 and scope 2 reporting requirements.

As the fate of the rule hangs in the balance, experts predict it will face further challenges with Trump back in the White House.

“I think there will be political pressure under a Trump administration for the SEC to back away from the final [climate] rule,” Julie Anderson, a professor and program director for the sustainability management program at American University’s Kogod School of Business, told ESG Dive prior to the election.

The agency’s climate-risk disclosure rule isn’t the only piece of regulation that could end up on the chopping block under a Trump presidency.

The SEC has several other ESG-related regulations on its agenda, including rules focused on greenwashing, human capital management and corporate diversity — all of which are either in the rulemaking process or pending finalization. However, none of these have been finalized so far, and President-elect Trump is expected to be sworn into office on Jan 20. It is questionable, at best, if his administration would continue the rulemaking processes on those measures.

Department of Labor’s ESG rule

Outside of the SEC, the Department of Labor has a rule that is likely to find itself targeted, as well. The rule, Prudence and Loyalty in Selecting Plan Investments and Exercising Shareholder Rights, has been in effect since 2023 and allows fund managers allows pension fund managers to consider ESG factors when making investment decisions, but only as a tiebreaker when two or more investments “equally serve the financial interests of the plan.”

The rule was initially challenged by 26 Republican state attorneys general and dismissed in September 2023 by Texas Northern District Court Judge Matthew Kacsmaryk. However, Kacsmaryk’s dismissal leaned on the Chevron doctrine, which has since been overturned by the U.S. Supreme Court. Critics appealed the ruling on June 28, the same day the doctrine was overturned.

The Republican-led coalition — also backed by Liberty Energy, Liberty’s oilfield services subsidiary and energy trade group the Western Energy Alliance — reprised its stance in an October motion which argued the ESG rule’s tiebreaker standard is contrary to the Employment Retirement Income Security Act of 1974 and should be vacated.

The case is currently being reviewed in Texas’ Northern District Court, after being remanded by the Fifth Circuit of Appeals, though the latter said it will retain the case on its docket, per the July 18 decision release by its three-judge appellate panel.

Given the friction the Labor Department’s ESG rule has already received from the Republican party, experts expect the rule to receive further resistance under a Trump administration.

Josh Lichtenstein, a Ropes & Gray partner who leads the firm’s ERISA and benefits practice, previously told ESG Dive if a final determination isn’t reached in the legal challenge by the change in administration, expect a Republican-led government to likely stop defending it in courts. A Trump Labor Department would likely return to a focus on “pecuniary factors,” which it pushed in his first term.

However, Anderson argues that given the rule is already facing challenges, a Trump administration wouldn’t drastically impact how this plays out in court.

“Yes, the president can choose the leader of the SEC and push on the DOL and ERISA laws … but that’s already happening,” she said. “So, I’m not sure it gets worse under Trump.”