Dive Brief:

- Federal regulation of the power sector is driving up energy rates and threatening grid reliability, multiple state utility regulators told a U.S. House subcommittee last week. In particular, they warned about the potential impacts of proposed U.S. Environmental Protection Agency rules that would limit greenhouse gas emissions from fossil fuel power plants.

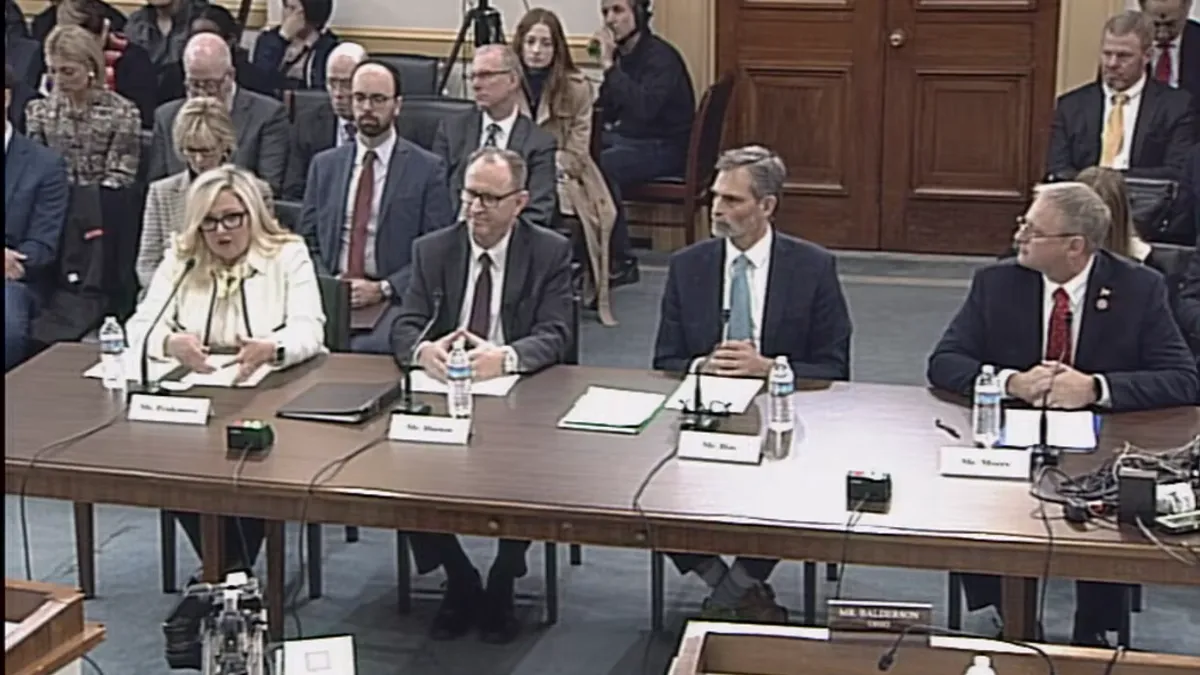

- “Customers are getting hurt by these regulations and stuck with the bill,” Tricia Pridemore, a commissioner with the Georgia Public Service Commission, told the House Energy, Climate, & Grid Security subcommittee. Up to 8% of a customer’s monthly bill already goes to “forced EPA compliance,” she said.

- But Keith Hay, senior director of policy for the Colorado Energy Office, painted a different picture for lawmakers. The state’s utilities are projected to reduce GHG emissions by up to 87% by 2030 and the shift to cleaner energy resources “illustrates the important role of the federal government in supporting states with this transition.”

Dive Insight:

House lawmakers heard from four state energy officials on Feb. 14, and three from conservative-leaning states placed blame for higher energy prices on federal regulation.

Indiana had some of the lowest-cost electricity rates in the country until the early 2000s, when federal regulations forced utilities to invest in emissions reduction, said Jim Huston, Chairman of the Indiana Utility Regulatory Commission.

In 2020, Indiana ranked 29th in electricity rates, Huston said. Today, coal is about 45% of the state’s generation — with a mix of gas, nuclear and wind also helping keep the lights on.

EPA says its proposed GHG restrictions will cause the retirement of about 22 GW of coal-fired capacity by 2035. Indiana submitted comments to EPA outlining concerns about the “unrealistic timing” of the rule, said Huston.

“It is not obvious that the proposed environmental benefits outweigh the other pillar considerations that state regulators must consider: to ensure safe, reliable service at affordable rates,” Huston said. “Energy policies should rely on state commissions’ management of 20-year planning horizons, effective policy and regulation.”

Arizona approved almost 2 GW of solar+storage last year, said Nick Myers, a commissioner on the Arizona Corporation Commission. But “many of the challenges we face moving forward with regard to reliable generation center around early forced retirement of coal plants without adequate replacement.”

“Personally, it pains me to have to approve accelerated cost recovery for early shutdown of coal plants while at the same time authorizing recovery on new purchase power agreements — and then, because the utilities are ultimately responsible for keeping the lights on, we also have to approve the building of reliable dispatchable generation in the form of natural gas,” Myers said.

The ACC last year approved a 575-MW expansion of Salt River Project’s Coolidge Generating Station.

“If you're keeping count, that means our ratepayers are paying three times for the same energy generation that could be had by simply keeping our existing generation online until natural retirement,” Myers said.

EPA’s proposed GHG limits on fossil generators “puts the utility, the customer and the state regulator in an impossible position,” Georgia’s Pridemore said. “Penalizing utilities for operating generation facilities this EPA doesn't like opens a Pandora's box for third parties to sue utilities. The EPA is seizing control from states.”

Colorado’s Hay had a more sanguine view of the federal government’s involvement in energy policy. The state’s last coal plant will close at the end of 2030, and he said the Colorado’s Energy Office is preparing to release a study — with modeling done by Ascend Analytics — evaluating deep grid decarbonization pathways by 2040.

“The modeling shows that under a business as usual approach, which is the lowest cost scenario to meet projected 2040 load, the Colorado grid achieves more than a 94% reduction in greenhouse pollution,” Hay said. “It does this by adding significant amounts of wind, solar, and batteries, while retaining a gas generation fleet that is approximately the same size as the gas fleet in service in Colorado today.”

By 2040, Hay said gas will provide Colorado with less than 2% of its electricity, with wind, solar, and batteries providing roughly 70% of electricity and energy efficiency meeting about 9% of energy needs. Modeling also shows the need for flexible, firm and dispatchable resources like geothermal, clean hydrogen, or gas with carbon capture along with adequate transmission, he said.

Combustion turbines powered by clean hydrogen will play a vital role and are expected to be among “the lowest cost types of clean firm electricity as a result of federal incentives under the Inflation Reduction Act,” Hay said.