Dive Brief:

- The Task Force for Climate-related Financial Disclosures issued its sixth and final progress report earlier this month, and said 19 global jurisdictions accounting for 60% of the global GDP have proposed or finalized climate disclosure requirements that align with TCFD’s framework.

- The group, using artificial intelligence technology, found that 58% of companies disclosed information aligning with at least five of TCFD’s recommended disclosures in 2022, up from 18% in 2020, according to an analysis of public company reports from 2020-22. Only 4% of companies had disclosures that aligned with all 11 of TCFD’s recommendations.

- The group was absorbed by the International Sustainability Standards Board in 2021. ISSB will assume responsibilities for TCFD reporting companies as part of its growing portfolio.

Dive Insight:

The group, which was formed in 2015 by the Switzerland-based Financial Stability Board, disbanded in conjunction with the release of this report, believing their mission culminated with the release of ISSB’s inaugural standards in July, which incorporated their work into its framework. TCFD said it was encouraged by how companies have progressed in climate disclosures and believes its recommendations helped drive that push.

The report found that 97 of the world’s 100 largest companies have either declared support or reported in line with the task force’s recommendations, or both. Additionally, over 80% of the largest asset managers and 50% of the largest asset owners reported in line with at least one of the 11 TCFD recommended disclosures.

“The Task Force on Climate-related Financial Disclosures has been instrumental in advancing consistent climate-related financial disclosures around the world,” FSB Chair Klass Knot said in a release. “Its recommendations serve as the basis upon which the ISSB and various jurisdictions have built disclosure requirements.”

The group found that between 2020-22, the percentage of companies that reported on climate risks or opportunities, board oversight and climate targets significantly increased. In 2022, 62% of analyzed companies reported on climate risks and opportunities; 64% reported on board oversight; and 66% reported climate-related targets, up from 36%, 39% and 42%, respectively.

However, TCFD also noted that not enough companies were sharing useful information about how their businesses could be impacted by climate change, which could hinder efforts to assess and price climate risks. The report found just 25% disclose how they integrate climate-related risks into their overall risk management framework, though that stat is up from 11% in 2020.

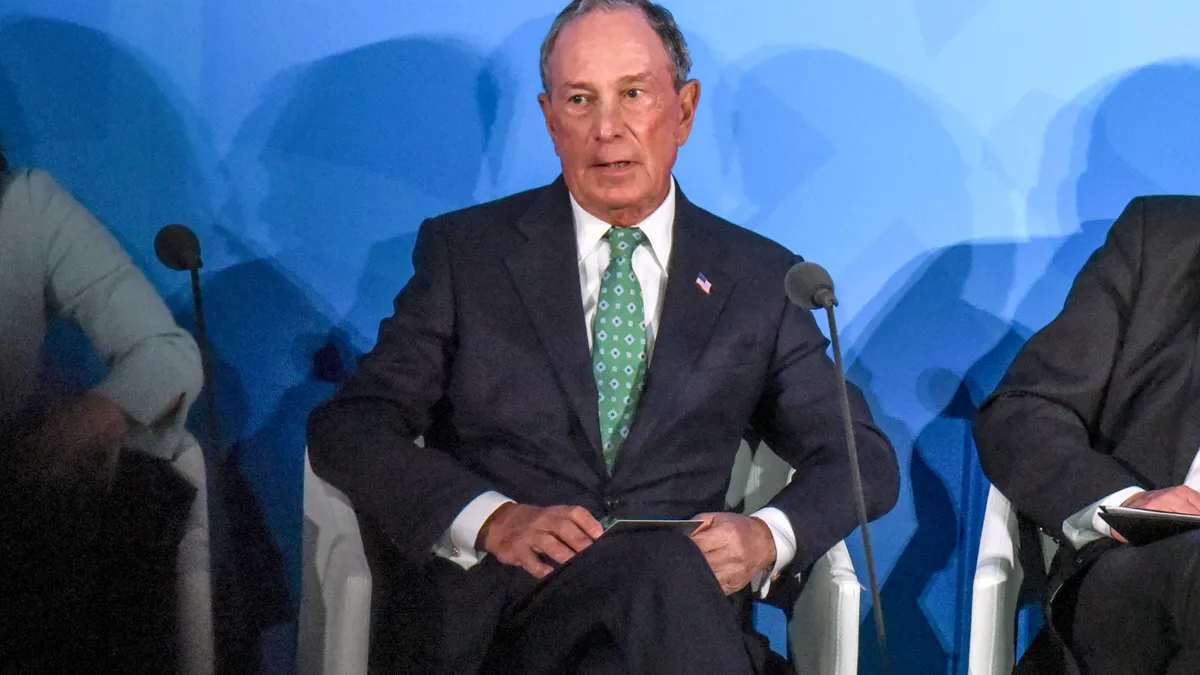

[A]lthough companies continue to make progress in their disclosures, significant gaps in data remain,” TCFD Chair Michael Bloomberg said in a letter to Knot. “In particular, reporting the impact of climate change on companies’ businesses, strategies, and financial planning is still lagging behind.”

Though the group’s work is drawing to a close, it announced it will create a free, public and global repository of climate-transition related data. The Net-Zero Data Public Utility will provide a central source of emissions and target data, a move Bloomberg described as a “major step forward in the comparability and availability of data.”

ISSB’s assumption of reporting oversight completes its absorption of TCFD’s work. The group, backed by the International Financial Reporting Standards Board, announced at its inception that TCFD’s climate reporting framework would be incorporated into the sustainability and climate disclosure standards.

With various global governments and jurisdictions — including the European Union, United Kingdom and Japan — signaling alignment or incorporation of the ISSB’s standards, other disclosure platforms are also coming aboard.

The environmental disclosure platform and climate research firm CDP announced last week it will align its disclosure questionnaire with the ISSB’s standards starting next year. Last week, the platform said that it had a record 23,000 companies disclosing through the platform.