Carbon reduction and ease of recycling at end of life are among the sustainability considerations driving some manufacturers to make alternative inks and packaging coatings for their customers.

The commonly used pigment in black inks is carbon black, which is made from hydrocarbons such as tar, petroleum and natural gas. Its use in printing has cropped up in recent legislative debates, with some lawmakers pushing to phase out carbon black in favor of certain alternatives.

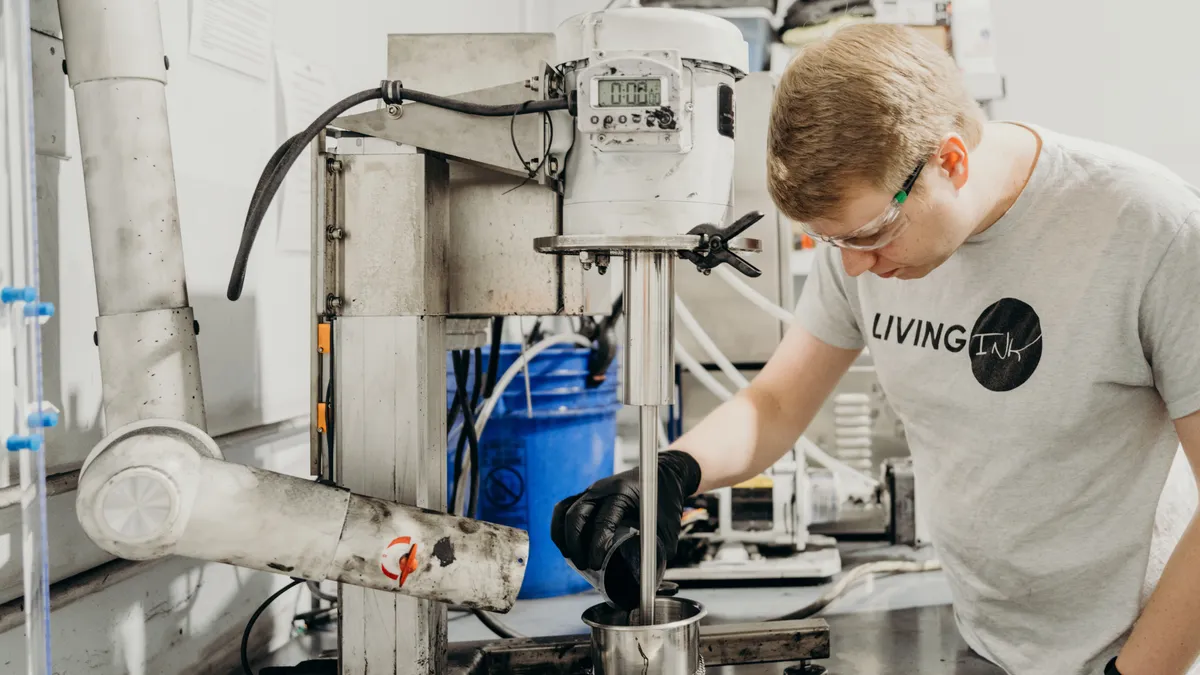

Living Ink Technologies is one company that produces an alternative that does not originate from the extraction and burning of dense petroleum substances. To make their algae-based ink, the company thermally treats biomass to become a type of biochar. Then, through patented technology, the crude biochar is purified and stabilized. From there, the pigment is finely milled and mixed with a soy- or water-based liquid medium to create printing ink.

A Colorado State University research team conducted a life-cycle analysis that confirmed the company’s proprietary Algae Black pigment can achieve carbon negativity at large-scale production, indicating that the manufacturing process removes more carbon from the environment than it contributes. This is thanks to the raw material’s ability to absorb atmospheric carbon dioxide. Living Ink, headquartered in Colorado, currently has the capability to produce roughly 500 kg of ink daily.

According to Devon Murrie, director of partnerships and strategic growth at Living Ink, one additional benefit of the company’s pigment is the larger particle size, which improves worker safety. “Carbon black is so fine, the particle size is so small … it’s really easy to inhale it,” she said.

Algae isn’t the only option for feedstock. “We’ve also tested, successfully, working with spent yeast and grain from beer fermentation, or biomass from pharmaceutical fermentation,” said Murrie. “The ability to scale is really, really massive.”

Origin Materials, a company focused on carbon negative materials, also offers a carbon black alternative. Instead of fossil fuels, its product is derived from sustainable wood residue, such as a locally sourced, Forest Stewardship Council-controlled residue that is a byproduct of lumber and wood flooring production. The primary components — cellulose, hemicellulose and lignin — are chemically deconstructed and reconstructed within a reactor to produce a solid carbon composite material, hydrothermal carbon.

“HTC has a submicron morphology that’s very similar to carbon black,” said a spokesperson from Origin Materials via email. “We then apply a post-treatment process to modify the surface chemistry of HTC to best accommodate a given carbon black application.” This includes one treatment for tire rubber filler and a slightly different treatment for inks and coatings.”

The company cites consistency of product composition and process stability as some of the leading challenges to scaling the production of such a substitute, but it said its HTC carbon black replacement overcomes these challenges. Plus, Origin points to stable pricing as another potential benefit to carbon black alternatives, which could be impacted by feedstock costs.

“Biomass tends to be priced locally and over multi-year contracts, while oil prices can vary wildly,” said the spokesperson.

In some cases, solvent-based ink on packaging can impact recyclability and act as a contaminant, a concern which has led to language in some recent state legislation. Earlier this year, legislation introduced in New Jersey proposed restricting “non-detectable pigments including carbon black.”

And in New York, an extended producer responsibility bill sought to establish recyclability criteria that would have disallowed certain additives, along with inks and adhesives that render packaging non-recyclable or are considered disruptive to the recycling process. The trade group Printing United Alliance is among those who raised concerns about the bill. Opposition prompted legislators to amend the bill language to drop the specific reference to carbon black as a toxic chemical. The resulting bill failed to pass before the state’s legislative session formally ended in June.

Statewide legislation could instigate change across the broader print industry as packaging manufacturers scramble to comply. And as many brands prepare to meet EPR requirements, or put new policies in place as part of broader sustainability commitments, sources say that many brands will prioritize products with lower environmental effects and smaller carbon footprints.

“Brands are asking about bio-based solutions for everything, ink being a good opportunity,” said Kevin Dooley, chief scientist at The Sustainability Consortium, via email. TSC, an organization focused on consumer product sustainability, notes that many brands seek a third-party certification when selecting a biobased ink. Examples include the U.S. Department of Agriculture’s BioPreferred Program, or a biobased content validation.

While some inks and additives can potentially hinder recycling, some alternative coatings for packaging substrates aim to make recycling easier. Ravish Majithia, CEO and cofounder of Magnomer, said that packaging designs have often prioritized ease of manufacturing over recyclability.

In an effort to close this gap, his company creates magnetizable coatings for packaging such as shrink sleeves. Majithia pointed out that many shrink sleeves are “basically the same density” as PET bottles, and so separation in a sink-float tank is bothersome in recycling facilities.

“Increasingly, they sort it through … quite literally physical scraping of these bottles, using what’s called mechanical de-labelers,” Majithia said. “As you can imagine, it is a very ineffective process.”

Magnomer’s products seek to solve this challenge by leveraging existing magnetic sorting technology in recycling infrastructure. Tests of the technology at companies such as Evergreen Recycling have shown that more than 98% of PETG flake was removed from PET bottles during magnetic separation. The coatings don’t impact brand artwork, and Magnomer’s products ensure inks do not bleed during wash steps in recycling operations.

“Evergreen Recycling ... highlighted the fact that the ability to remove the labels magnetically not only allowed them to reduce the contamination, but also, it’s an opportunity to recycle the label itself,” Majithia said.

Interest in alternative inks and coatings is on the rise: Sources expressed that companies are keen to find solutions that make it easier to fulfill environmental commitments.

“When we talk to different groups, they all have different goals in mind,” said Murrie of Living Ink. Customers cite carbon reduction in their supply chain, plant-based products and waste reduction among the chief concerns. “They’re thinking … about the circularity potential for their products.”