Dive Brief:

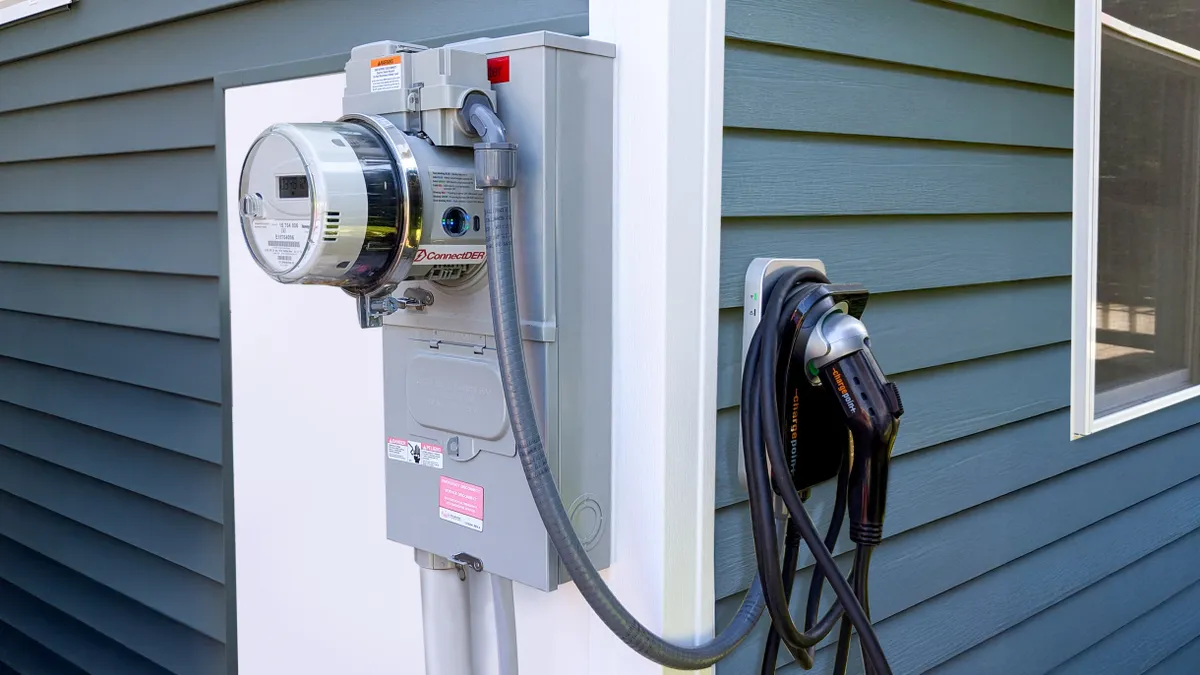

- ConnectDER, a company which sells home adapters for electric vehicles and solar panels, announced Tuesday it secured $35 million in a funding round led by Decarbonization Partners, a joint venture between BlackRock and Singapore-based investment firm Temasek.

- Decarbonization Partners joined the latest series of funding as one of two new investors, alongside MassMutual Ventures. Six previous investors also participated in the funding round, according to a Dec. 3 press release.

- The funding is expected to allow ConnectDER to accelerate its growth as it unveils a new meter-socket adapter. This “IslandDER” adapter is designed to integrate with the utility grid and enable whole-home energy backup and resiliency through its ability to disconnect and reconnect to the grid, according to the release.

Dive Insight:

ConnectDER said the funding round will help accelerate the company’s market expansion and product innovation, as it rolls out IslandDER. The new meter-socket adapter is designed to allow “seamless” utility grid integration, to enable homeowners to power their homes with solar capacity, battery storage, EVs or other forms of distributed power whether connected to the utility grid or not, through a process called “islanding.”

ConnectDER CEO Ivo Steklac said in the release that the funding round will allow the company to expand its offerings in existing markets and scale manufacturing, as well as allow it to bring the IslandDER product to market.

“Our forthcoming IslandDER enables homes to disconnect and reconnect from the grid enabling customers to harness stored energy from solar plus battery systems or EVs providing innovative backup power and resilience to market at an incredibly competitive cost point," Steklac said.

An estimated 60 million U.S. homes don’t have the capacity for solar, EV-charging or other distributed energy solutions, according to electrification nonprofit Rewiring America. ConnectDER said its products cost 10%, or less, than the typical cost of upgrading a home’s service panel or utility interconnection. By cutting that cost, ConnectDER said its product helps remove “a critical barrier to adoption.”

In addition to Decarbonization Partners and MassMutual, ConnectDER received funding from the technology investing arm of South Korean electronics and home appliance company LG Corporation, which had previously invested in the company. Other prior investors who participated in the latest funding round include Clean Energy Ventures, Energy Innovation Capital, Avista Development, Evergy Ventures and Zoma Capital.

Decarbonization Partners Global Head and Chief Investment Officer Meghan Sharp said the ConnectDER team “built an elegant solution that solves a major adoption pain point for customers, enabling and accelerating affordable home electrification in North America.”

After surpassing $1 billion in investments in October 2023, the BlackRock and Temasek joint venture said it had closed a $1.4 billion funding round earlier this year for its first late-stage private equity fund.