Dive Brief:

- A coalition of 534 financial institutions that collectively manage $29 trillion in assets is urging global governments to “take robust action” to address the climate crisis at the COP29 climate forum and enact policies to unlock the private capital needed to support a green transition.

- Investors outlined their concerns and demands in a 2024 Global Investor Statement to governments released Tuesday. The coalition is spearheaded by the founding members of The Investor Agenda, which is a climate leadership initiative from Ceres, the United Nations Environment Programme Finance Initiative, the Carbon Disclosure Project and others.

- The statement arrives a few days before New York’s Climate Week commences and a little less than two months before the United Nations’ annual climate summit. The letter asks policymakers to implement strategies that mandate climate-related reporting and disclosures, address biodiversity related challenges and boost private investment targeting climate mitigation, among other climate-focused initiatives.

Dive Insight:

Members of the Investor Agenda — which also include the UN-backed Principles for Responsible Investment, Asia Investor Group on Climate Change, Investor Group on Climate Change and the Institutional Investors Group on Climate Change — called on governments to set more ambitious goals for their enhanced emissions reduction plans or Nationally Determined Contributions. Nearly 200 countries are due to present their NDCs to the UN next year for the period of 2025-2035, nearly a decade after the Paris Agreement was first introduced.

The Sept. 17 letter asked governments to ensure the 2030 and 2035 targets outlined in their NDCs are aligned with the Paris Agreement’s goal of limiting global temperature rise to 1.5°C and that they provided financial incentives such as grants and loans to spur the development of climate technology that facilitated a net-zero transition. Signatories urged policymakers to scale up the deployment of low-carbon energy systems and support electrification, storage and clean energy infrastructure.

The letter also asked governments to remove fossil fuel subsidies and swap them with clean energy subsidies or tax breaks that would encourage clean energy use and boost low-emission fuels. Building on this, signatories asked policymakers to introduce plans and targets to “phase out unabated fossil fuel use in line with credible 1.5ºC pathways including by ramping up pollution standards for large emitters and energy efficiency standards in end-use sectors.”

Mindy Lubber, CEO and president of Ceres, said tackling the climate crisis requires a “whole-of-government approach,” mirroring the letter’s call for public-private partnerships, non-policy mechanisms, sector-specific strategies and other collaborative efforts to address and mitigate climate change.

“These critical policies to tackle climate change and nature loss will unlock the private capital needed to accelerate the just transition to a resilient, low-carbon, nature-positive economy,” Lubber said in a release accompanying the 2024 statement.

The statement’s signatories include California Public Employees’ Retirement System — the largest state pension fund in the U.S. — California State Teachers Retirement System, New York State Common Retirement Fund, New York City Comptroller’s Office, UBS Asset Management, BNP Paribas Asset Management, Sierra Club Foundation and over 500 others.

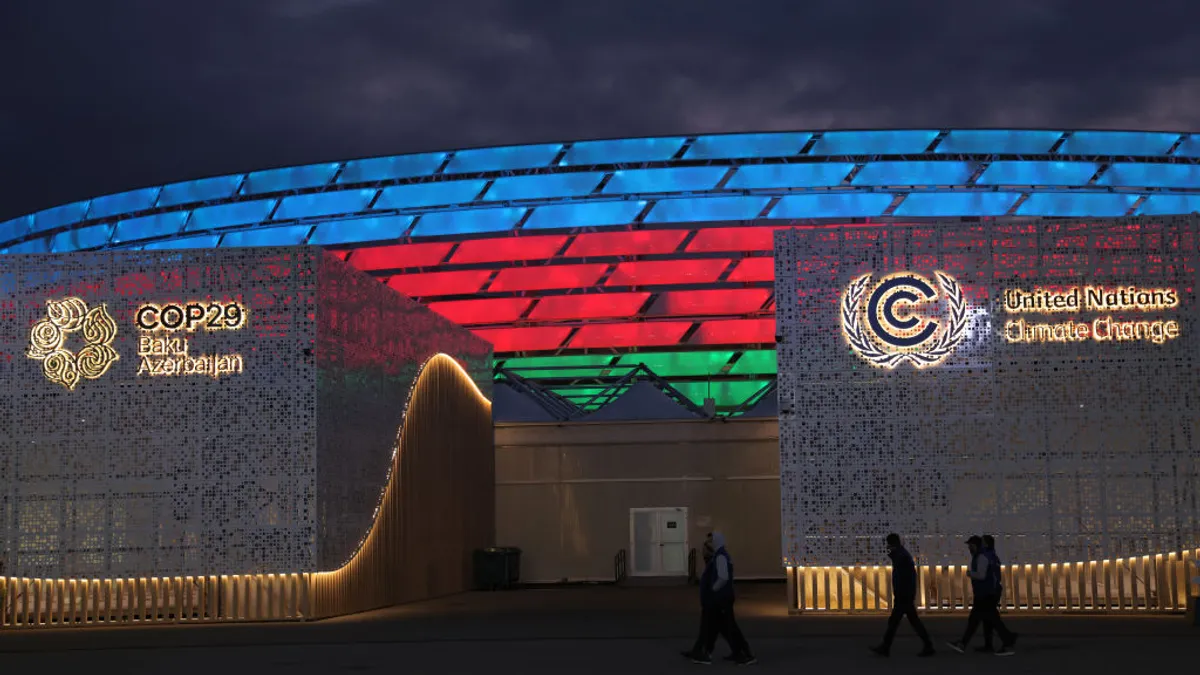

Additional investors can join the initiative and sign the statement until Nov. 1, ahead of the COP29 summit in Baku, Azerbaijan the same month. The letter, along with a final list of signatures, will be presented to participating governments at the conference.